Responsive

eBanqr is 100% responsive, meaning the same application looks good on all devices – smartphones, tablets and computers. Thus, field agents can enter collections securely from their smartphones in real-time, while out of the office. Financial institutions can comfortably work on the platform from low cost tablets, without necessarily investing in computers.

SMS & Email notifications

The platform supports SMS notifications. Finanacial institutions control which of their clients get notifications, and for what. They also control their SMS credits.

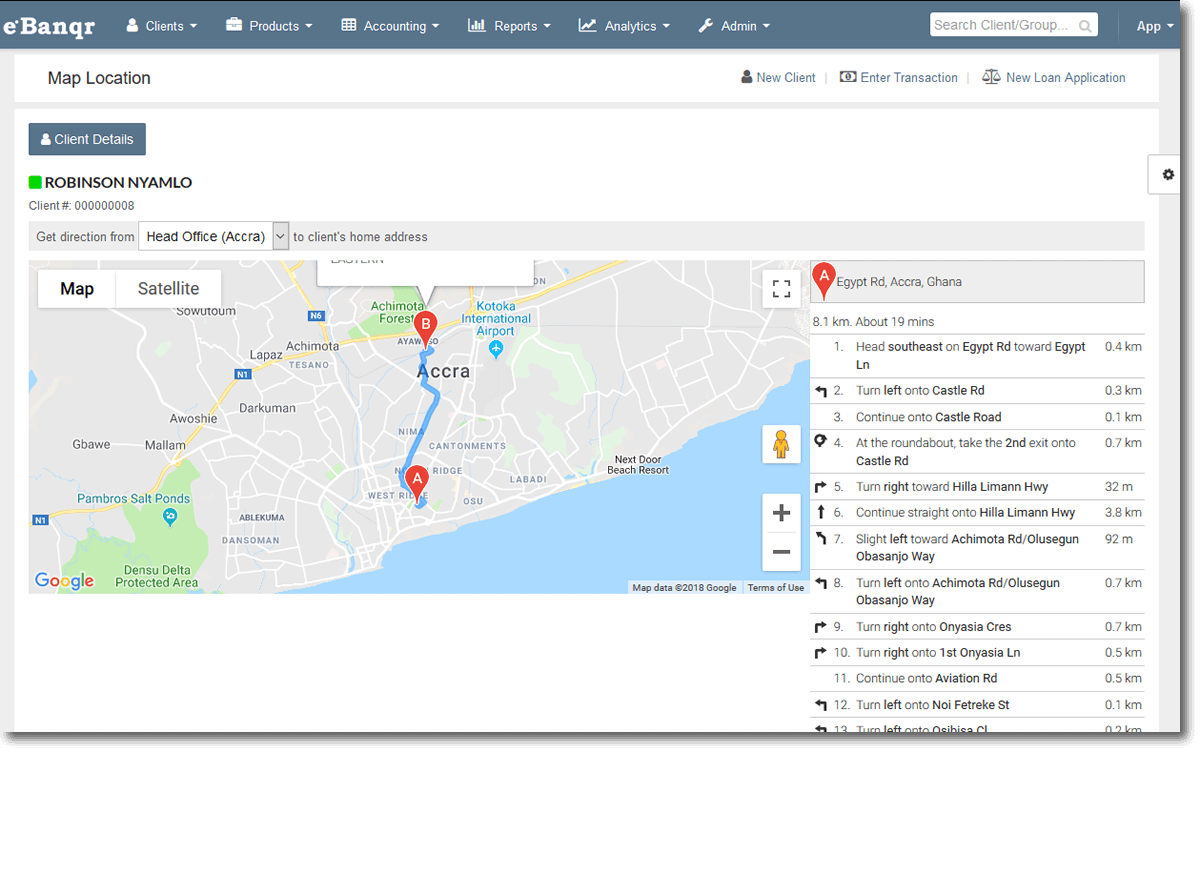

Map locations & directions

In countries where addressing systems are not good, eBanqr provides a means of storing the GPS address of customers. Field agents can get directions to exact locations of customers from branch offices.

Customer self-service

eBanqr supports customer self-service, where customers can see the status of their acoounts and transactions. Thus, subscribers to the platform can offer online banking to their customers.